USD Reacts to Mixed Inflation Data: Eyes on ECB Meeting

The US Dollar is currently undergoing a knee-jerk reaction, with traders making slight adjustments to their Greenback positions following the release of the hot Consumer Price Index data from Wednesday. The recent unveiling of the Producer Price Index (PPI) final reading for March has contributed to this flux in the market sentiment. While the PPI fell in line with expectations, the anticipation was for a more upbeat surprise. The revelation that producers are experiencing less severe inflation compared to the earlier CPI print suggests a potential easing in forthcoming CPI releases.

In the realm of economic data, all eyes are now on the European Central Bank meeting, where Christine Lagarde is expected to provide further insight into the ECB's current 'unchanged' stance. Additionally, market participants eagerly await remarks from New York Fed President John Williams and Boston Fed President Susan Collins. Should these Fed officials express a measure of resistance against the significant movement observed on Wednesday, a minor repricing could be underway.

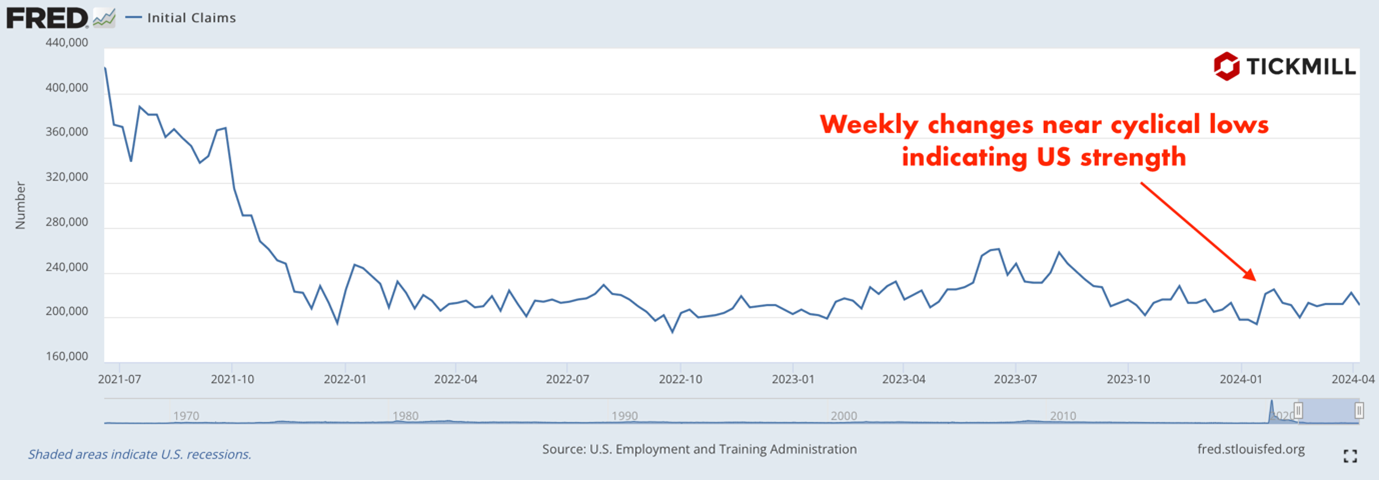

The ECB's Policy Rate decision has been announced as unchanged from the previous stance. Meanwhile, a slew of US data has flooded the market. Initial Jobless Claims for the week ending April 5 saw a marginal decrease from 214,500 to 214,250:

Turning to the PPI data for March, the monthly headline PPI declined to 0.2% from the previous 0.6%, while the yearly headline PPI surged to 2.1% from 1.6%. The monthly core PPI met expectations at 0.2%, indicating a slowdown from the previous 0.3%.

Federal Reserve Bank of New York President John Williams is scheduled to deliver remarks today. Following Wednesday's release of hotter-than-expected US consumer inflation data, expectations for the Fed to maintain interest rates at the June meeting have skyrocketed to over 80%, up from roughly 40% prior to the CPI figures' release.

The US Dollar Index has surged above 105.00 for the first time this year, establishing a fresh five-month high around 105.32. With prospects of the Fed prolonging the period of stable interest rates compared to other major central banks, rate differentials are poised to come into play, potentially fueling further strength in the US dollar. As the market recalibrates after Wednesday's significant movement, new levels of resistance need to be identified for potential upside. The near-term significant level is the November 10 high at 106:

Shifting focus to geopolitical developments, China has imposed sanctions on two US companies for allegedly selling arms to Taiwan, as reported by Bloomberg. This development adds another layer of complexity to the ongoing global landscape, potentially influencing market sentiment and investor behavior in the days ahead.

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 72% and 73% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.