USD Retreats as Weak US Services PMI Turns Tables for EUR and GBP

EUR/USD is staging a rebound, reclaiming ground above 1.0850 on Thursday, buoyed by the release of lower-than-anticipated ISM Services PMI figures from the US.

The decline in Prices Paid, dropping from 58.6 to 53.4, signals a notable cooling of inflation within the sector, thus amplifying the likelihood of a Federal Reserve interest rate cut by June.

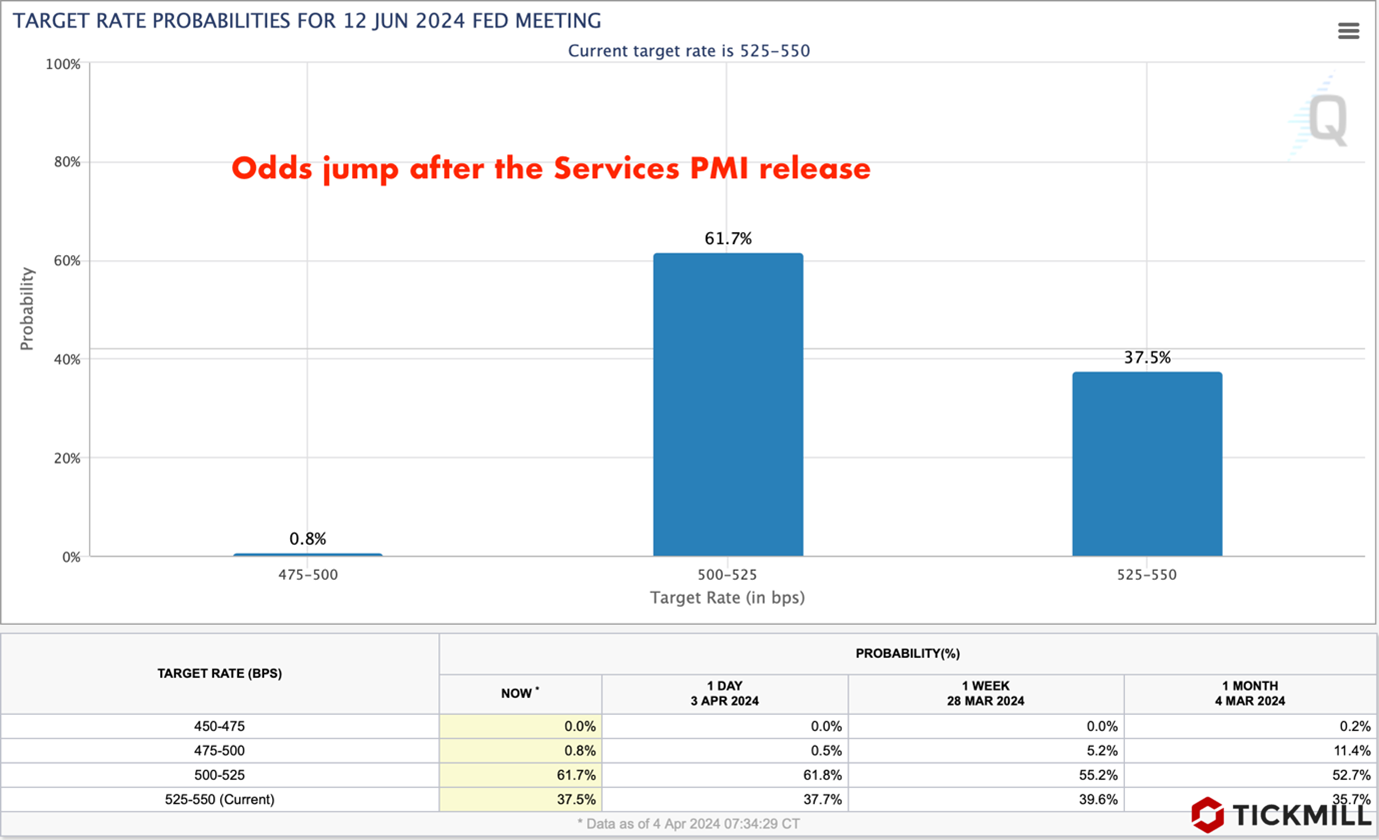

This sentiment was mirrored in the pricing dynamics of futures contracts tied to the federal funds rate, which now imply a market-derived probability of over 61% for a rate cut by June, up from the 50% observed on Monday:

The minutes from the European Central Bank's March policy meeting, disclosed on Thursday, underscored the expectation of a continued downward trajectory in inflation across the Eurozone in the forthcoming months.

As per the Minutes, it was acknowledged that there had been further advancements across all three facets - wage inflation, services inflation, and goods inflation - instilling heightened confidence in the trajectory towards the ECB's inflation target. Additionally, the Minutes indicated a strengthening case for contemplating rate cuts.

The weakening of the inflation outlook in the US, as evidenced by the Services PMI data, emerged as a significant driver for the reassessment of EURUSD. This shift in sentiment, triggered by the data release, prompted bullish momentum to kick in earlier than expected based on our prior technical analysis. Buyers managed to strengthen their position from the horizontal support level, propelling the price to its highest point since March 26 at 1.0850. With buyers seizing control of the narrative, sellers might opt for a cautious approach, allowing buyers to pursue their objectives, potentially culminating in a retest of the upper boundary of the current bearish trend, which lies in the range of 1.09-1.0950:

Looking ahead to the remainder of the week, the focal point for the US Dollar will undoubtedly be the release of the US Nonfarm Payrolls report for March, scheduled for Friday. This economic indicator will wield significant influence over market sentiments regarding the potential commencement of interest rate reductions by the Federal Reserve starting from the June meeting. Projections for the NFP report anticipate the addition of 200K workers during the month, a slight decline from February's robust figure of 275K.

The GBP/USD pair showcases resilience, buoyed by recent economic signals from the United Kingdom and US data, indicating a promising trajectory towards economic recovery after enduring a technical recession in the latter half of 2023.

Of note, the UK's Manufacturing PMI unexpectedly expanded in March, marking a notable turnaround from a contraction spanning 20 consecutive months, propelled by robust domestic demand. The upbeat performance of the UK's manufacturing sector has propelled business optimism to its highest level since April 2023.

Furthermore, the British real estate market exhibited strength, with house prices surging by 1.6% in March, the most significant increase since December 2022. This suggests that despite historically elevated interest rates, the real estate sector in the UK remains resilient and continues to demonstrate resilience.

Similar to the Euro, the upward momentum in GBPUSD was predominantly influenced by the recalibration of expectations regarding a potential June rate cut by the Fed, triggered by the ISM Services data release, rather than any domestic news from the UK.

Moreover, the anticipation of a dovish surprise in the NFP data, coupled with the resurgence of bullish momentum, lends credence to the scenario where the price could feasibly test the significant resistance line converging with the nearby horizontal support level around the 1.28 mark:

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 72% and 73% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.