Helicopter Money: Benefits, Limitations and Perils

The ECB will probably signal at the September meeting that it will turn on monetary spigots. However, if the Governing Council does not begin to think outside of the box, experimenting with new policy instruments, the central bank will be stuck in a rut of declining payoffs of the traditional methods. Reducing rates below the current level can hardly accelerate investment, but it will definitely strengthen the thinning of the banking sector profit margin.

Despite the economic recovery and a very cautious deviation from the policy of accommodation, the ratio of capital expenditures to GDP in the Eurozone has not returned to historical norm. All that traditional easing can do in the current situation is to keep consumer and corporate sentiment metrics from falling further and, of course, to maintain optimism in the stock market.

To achieve a real economic effect, the ECB needs to create conditions for a positive and sustainable shock in consumption. The impact of money supply expansion on aggregate demand through the traditional interest rate channel is exhausting, and perhaps the central bank should try to directly influence consumer spending through the so-called “helicopter money”. How will it work? For example, the ECB can make a monthly transfer of €100 to the current accounts of EU citizens, which, in theory, should their ability and will to spend. But why should it increase spending and not go to savings? It is reasonable to assume that under the normal level of consumer confidence, the precautionary savings motive will give way (in aggregate measure) to the desire of consumption, which is reinforced by the fact that the central bank will guarantee this “income”. The transfer can also be designed to have limited lifetime and negative interest rate applied to it, so it should “force” people to spend it.

The increase in consumption will have to lead to accelerated inflation and as this process intensifies, the size of transfers can be reduced in proportion to the increments of inflation, until the target inflation rate is reached. Adjusting the size of monthly transfers to the dynamics of inflation will become a mechanism to prevent it getting out of hand. The absence of government involvement in this process and linking of the measure to the specific goals of the Central Bank (comfortable inflation and unemployment rates) will make it inappropriate to argue that the central bank directly finances public debt, which is prohibited by article 123 of the EU Treaty.

Of course, if we try to track helicopter money in the balance sheet (assets and liabilities), we can note that they will increase Central Bank liabilities (because the Central Bank issues banknotes or increases reserves for that) without a corresponding increase in assets. In the case of QE, changes occur on both sides of the balance sheet - banknotes (reserves) are issued from the liabilities side, purchased bonds appear on the asset side. It may seem that significant increase in liabilities because of helicopter money is a direct road to bankruptcy. To show that this is almost not the case, let us express the “bankruptcy problem” for the Central Bank, with the following two specific questions:

- Does this lead to liquidity constraints of the Central Bank?

- Do changes in the balance sheet of the Central Bank lead to a loss of policy credibility, in particular, pursuit of the inflation target?

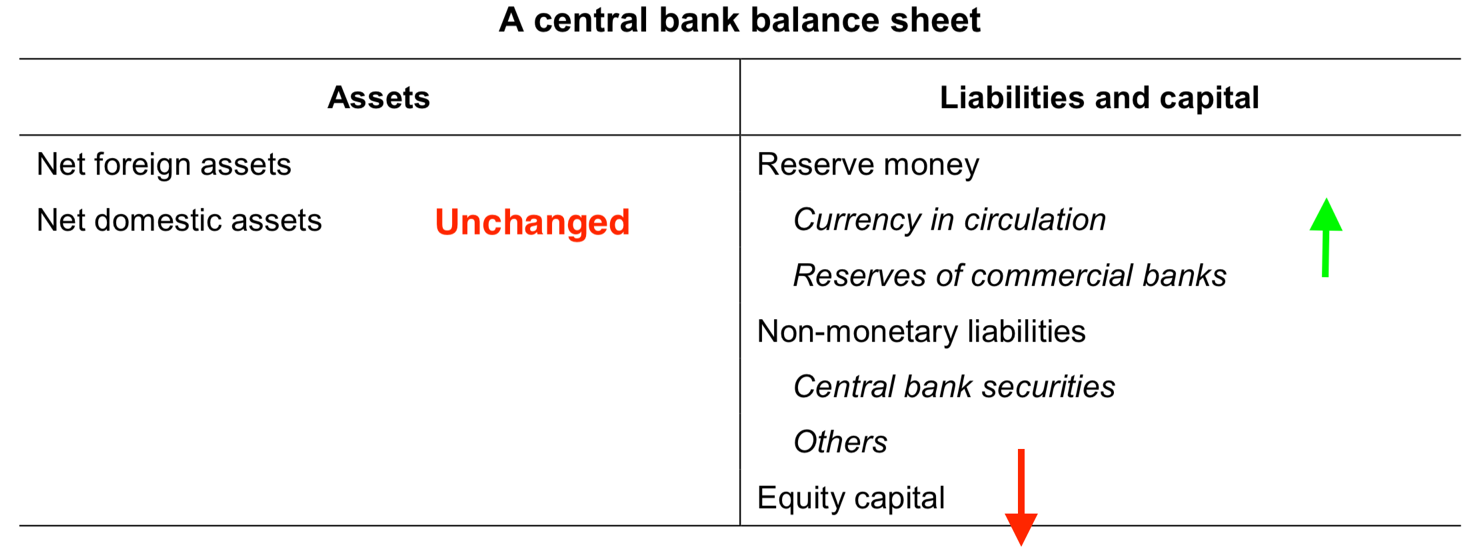

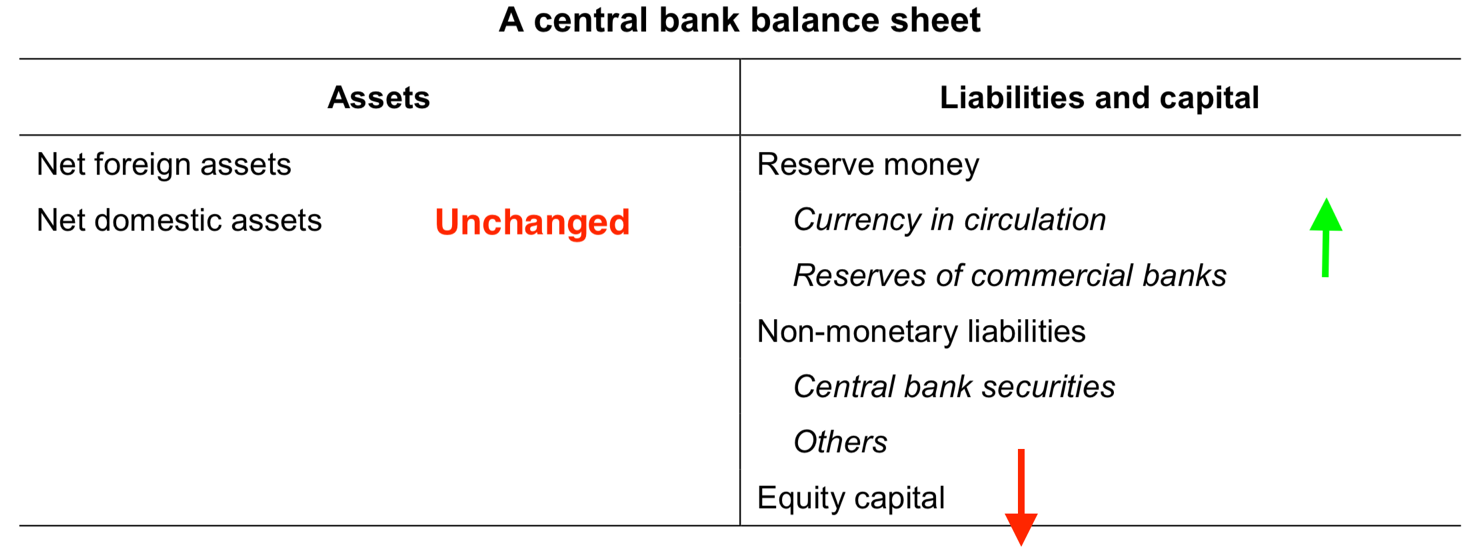

Consider the typical balance sheet of the Central Bank:

If we assume that with an increase in the Reserve money the size of the assets remains unchanged, Helicopter money operation should be balanced on the side of liabilities. That is, either by reducing non-monetary liabilities or by reducing the capital of the Central Bank. In the case of a large-scale operation of helicopter money, the equity capital of the central bank can become negative.

There are more exotic options to show helicopter money in the balance sheet – for example Central bank can create interest free loans to households with an infinite maturity that will balance increase in liabilities (a.k.a QE for people) or use deferred assets, which the Fed uses to reflect losses on the balance sheet.

Actually, the negative capital itself is not a problem (after all it is just an accounting record), but the liquidity constraint associated with it is a real threat. A commercial bank may continue to operate with negative capital (provided that it carefully hides it J), but in relation to all creditors it is immediately bankrupt. In the case of the Central Bank, such reasoning is inappropriate for two reasons:

- Firstly, the bank's monetary liabilities (banknotes and reserves) are irredeemable. Returning them to the Central bank what we can get at best is the other banknote with the same face value.

- It is also reasonable to assume that there will be no limitation in liquidity (and perceived as such), if there are expectations that the Central Bank will retain a monopoly on the issue of legal tender on an unlimited time horizon. This, of course, requires policy credibility because the government doesn’t need the Central Bank whom the people don’t trust to.

Hence there are no liquidity constraints of the Central bank to carry helicopter money operation, even unlimited in scope. Long-term price stability (efficiency of the Central Bank) doesn’t correlate with the size of equity, which, for example, is argued in this paper.

An analysis of the balance sheet also implies an interesting technical conclusion that the “genuine” condition for the solvency of the Central Bank is that the present value of non-monetary liabilities (“real debt”) on an unlimited horizon should be 0.

The answer to the second question is more ambiguous, since a sharp increase in the monetary base creates inflation control risks. Firstly, this is the unpredictability of the vector and the intensity of consumer spending using helicopter money. Secondly, if we consider the system of prices in the economy, which is basically a reflection of relative proportions of demand in the economy for different goods and which help to calibrate relative volumes of production of these goods, short-term and spontaneous demand boost from the helicopter money should create powerful distortions, confusing firms about real demand for their goods.

But in general, to suppress inflation, the Central Bank may try to resort to the following well-known measures:

- An increase in interest rates on reserves (soaking up liquidity from the economy).

- Selling bonds from the balance sheet (almost the same thing).

- Increase the reserve ratio for banks.

However, how effective will the measures be in response to inflation given by powerful consumer shocks? It is unknown. This is the main risk for the Central Bank, which so far holds back discussion about the helicopter money.

Please note that this material is provided for informational purposes only and should not be considered as investment advice. Trading in the financial markets is very risky.

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 72% and 73% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.