What to Expect from the December US Retail Sales Report?

In his Thursday address president-elect Biden announced $1.9 trillion economic recovery plan, but surprisingly, markets were not particularly excited about this. On the contrary, there was some doldrums. American indices closed in the red on Thursday, and the correctional motive has fed into to other markets today. Losses in European markets at the time of writing remain capped at 1 percent, oil quotes are noticeably lower. The dollar has recouped losses. Anticipated fiscal expansion in the US is pushing gold price up despite broad-based strengthening of greenback on Friday.

Jerome Powell said yesterday that it is premature to discuss when the Fed will begin to taper QE. This statement was expected since the Fed has no choice. If the government starts borrowing on the market again, the Central Bank will have to “collect” new debt on its balance sheet to maintain investors' appetite on the Treasury market. A side effect of this will be an increase in the money supply which is reflected in rising inflation expectations in the US and signs of a bond rout in Treasury market since the beginning on new year.

Powell warned that inflation will start to rise in the second quarter, so if inflation reports show positive aberrations from the forecasts, we still won’t be able to expect a switch to hawkish rhetoric from the Fed.

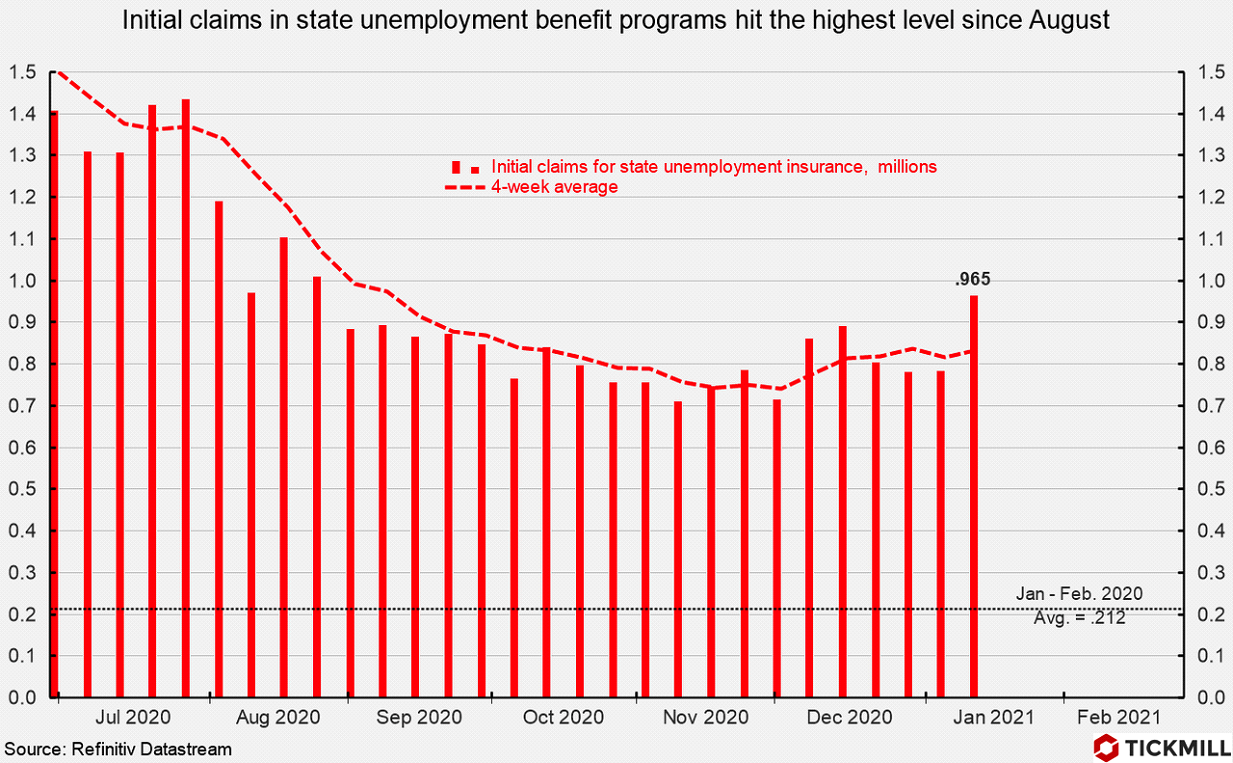

Claims for unemployment benefits for the previous week showed that the labor market is losing shape rather quickly: the number of initial claims increased from 787 to 965K. This is the highest value since August 2020. The number of continuing claims has also increased - by 141K.

It is no coincidence that Biden said that the repair of economy will start from the labor market - we see that the need for support grows quickly there.

Today the market is expected to be sensitive to the December US retail sales print. Weak NFP prompted investors to expect slowing of consumption in December and hence negative surprise in retail sales. If it turns out that the weakening of the US labor market could not break the consumer potential in the US and the growth of retail sales turns out to be higher than the expected 0%, greenback will likely fall under pressure from revival of risk-on and risky assets will get out of the corrective spiral. The negative deviation of retail sales is likely to be discounted.

Together with the report on retail sales, we expect the report of U. of Michigan to shed light on consumer spending picture in the US. The report will provide estimates of consumer optimism and inflation expectations for December. In November, the consumer confidence index dropped significantly (80.7 points) and is expected to continue to decline in December (80 points). As in the case of retail sales, the negative surprise should have been priced in, but a positive deviation will likely spur demand for risk today, as it will allow revising the effect of the labor market slack in December on the US economy.

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 75% and 65% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 72% and 73% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.