机构洞察:汇丰银行2026年外汇策略

2026年:权衡利弊

我们预计,受美联储宽松政策倾向的影响,美元整体将在2026年面临走软的局面。美元走弱将为其他货币提供支撑。

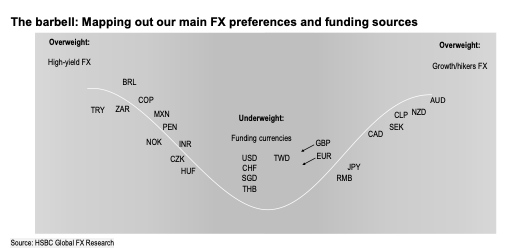

我们一贯偏好优质、高收益的新兴市场货币和增长型货币,尤其是那些央行即将加息的货币。具体而言,我们继续看好拉美货币,尽管我们也意识到该地区政治局势可能带来波动。尽管如此,我们仍然对该地区以及其他高收益货币(如南非兰特和土耳其里拉)保持乐观态度。对于增长型货币,我们维持对澳元、新西兰元和瑞典克朗的偏好。

今年的一个关键区别在于,我们偏好货币的融资来源预计将不再局限于美元。尽管美元可能保持疲软,但鉴于美联储的降息周期可能在美国经济展现出韧性的迹象下结束,美元再次大幅走弱的可能性似乎不大。这使得美元作为融资货币的地位有所下降,为其他货币承担这一角色创造了机会。例如,我们应该考虑欧元、新加坡元、新台币、泰铢和瑞士法郎等低收益率货币。此外,英国央行持续的宽松政策周期可能会继续对英镑构成压力。这些动态为我们提供了将偏好货币与这些低收益率替代货币对冲的绝佳机会。

Working it Out

Bringing all elements together, we believe a barbell-type approach encapsulates our perspective (refer to the chart on the previous page). However, we also draw on an earlier framework to explain why we favor certain currencies over others within this barbell strategy.

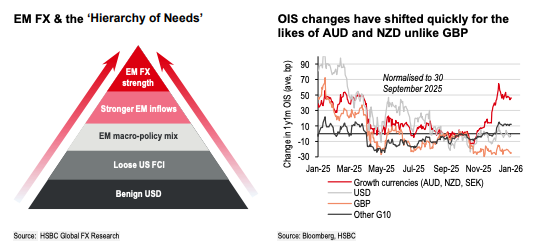

As long as global growth remains steady, the Federal Reserve refrains from rushing into rate hikes, and U.S. financial conditions stay relatively loose, the USD is likely to remain on the softer side. This creates a supportive environment for emerging market (EM) foreign exchange (FX) and other cyclical currencies, as highlighted in our ‘Hierarchy of Needs’ framework (refer to the chart above and see ‘In the Mix for 2026’, EM FX Roadmap). If local factors, such as robust EM growth conditions and sound macroeconomic policies, also show improvement, we could see a resurgence in portfolio inflows. This would place certain EM currencies in a stronger position, making them more likely candidates for currency appreciation.

Leveraging this framework, we continue to favor many Latin American (LatAm) and Central and Eastern Europe, Middle East, and Africa (CEEMEA) currencies over those in Asia. Some attribute the outperformance of these regions to high yields coupled with low cross-asset volatility, which is partially true. However, it also reflects prudent policy measures, as evidenced by relatively high real yields, particularly in LatAm. Furthermore, fiscal risks appear less concerning, supported by a downward trend in credit default swap (CDS) spreads in both LatAm and CEEMEA.

This broader perspective on FX opportunities highlights the potential advantage of shorting developed market currencies facing fiscal challenges, political and policy uncertainty, and/or weak growth prospects (USD, EUR, GBP, CAD, JPY) in favor of EM currencies with improving policy frameworks. A comparison of yield curve slopes between developed markets and EM underscores this point. In our view, the flattening of EM yield curves cannot solely be attributed to a weaker USD. Instead, they reflect stronger fiscal outlooks, recovering growth, and the likelihood of tighter monetary policies—currencies like the AUD, NZD, and potentially the SEK come to mind. Conversely, developed market currencies such as the USD, EUR, GBP, and JPY fail to meet these criteria confidently.

Lastly, we are often asked what factors could shift our view, particularly regarding the broader USD. As discussed in our latest Currency Outlook, if expectations of Fed rate cuts were to dissipate, this could stabilize the USD. However, this alone may not be sufficient to drive significant USD strength, especially if other central banks are perceived to be raising their policy rates. A more plausible scenario for a strong USD resurgence would involve the Federal Reserve initiating a hiking cycle much earlier than anticipated, at a time when markets have largely priced in tightening elsewhere or are expecting rate cuts. However, we believe this scenario presents a high threshold for the USD to achieve in 2026.

免责声明:提供的材料仅供参考,不应视为投资建议。 本文中表达的观点,信息或观点仅属于作者,而不属于作者的雇主,组织,委员会或其他团体或个人或公司。

过去的业绩不代表未来的结果。

高风险警告:差价合约(CFD)是复杂的工具,由于杠杆作用,存在快速亏损的高风险。 当与Tickmill UK Ltd和Tickmill Europe Ltd进行差价合约交易时,分别有72%和73%的零售投资者账户亏损。 您应该考虑自己是否了解差价合约的工作原理,以及是否有具有承受损失资金的的高风险的能力。

期货和期权:保证金交易期货和期权具有高风险,可能导致损失超过您的初始投资。这些产品并不适合所有投资者。请确保您完全了解这些风险,并采取适当的措施来管理您的风险。