FTSE 100 FINISH LINE 27/11/25

FTSE 100 FINISH LINE 27/11/25

The UK's FTSE 100 hugged the flatline on Thursday, weighed down by losses in the consumer staples and energy sectors. This followed Finance Minister Rachel Reeves’ unveiling of a tax-heavy budget on Wednesday. Reeves introduced a much-anticipated fiscal plan that raised taxes and doubled the government’s fiscal buffer to £21.7bn, exceeding market expectations despite increased welfare spending. Gilts rallied initially after the early OBR report highlighted this expanded fiscal headroom. However, concerns emerged regarding the backloaded nature of the tax hikes, raising questions about their implementation. The OBR’s 0.3 percentage point productivity downgrade would have reduced tax revenues by £16bn, but its pre-measures forecast for 2029-30 showed a £16bn increase, driven by higher inflation, wage growth, and a shift in GDP composition. The revised GDP mix, with greater reliance on labour income (taxed at 40%) and consumption (10%) rather than corporate profits (17%) and investment (-10%), is expected to boost tax revenues. Nonetheless, risks persist, as a 1 percentage point drop in the effective tax rate could slash £35bn from the budget balance, erasing the £21.7bn buffer. While gilts rallied on initial optimism, scepticism over OBR assumptions remains.

The blue-chip FTSE 100 index traded between very marginal gains and losses, influenced by thinner activity due to the US Thanksgiving holiday. Consumer-related stocks faced declines, with Unilever and British American Tobacco falling 0.7% and 1.2%, respectively. Personal goods stocks also struggled, as Burberry dropped 1.7%. Industrial miners fell 1.2%, with Anglo American and Rio Tinto each losing over 1.5%. Energy stocks declined 0.9%, driven by falling oil prices amid expectations of a ceasefire between Ukraine and Russia; BP slid 1.2%. In contrast, precious metal miners gained 0.7%, led by a 1.2% rise in Endeavour Mining. Homebuilders recovered with a 0.9% gain after a prior session’s dip linked to increased taxes on high-value properties. Elsewhere, British gambling companies saw sharp declines. Evoke dropped 7%, and Rank Group tumbled 9.5%, erasing Wednesday’s gains after both firms warned that higher taxes on online gaming would hurt profits. However, Playtech bucked the trend, surging 8.4% despite cautioning about a significant euro-denominated impact. Unite Group plunged 4.4% to its lowest level in over a decade after the student accommodation developer forecast reduced earnings for 2026. On a brighter note, online fashion retailer Debenhams soared 44.4% following a positive profit outlook. Severn Trent and 3i Group also declined as they began trading ex-dividend.

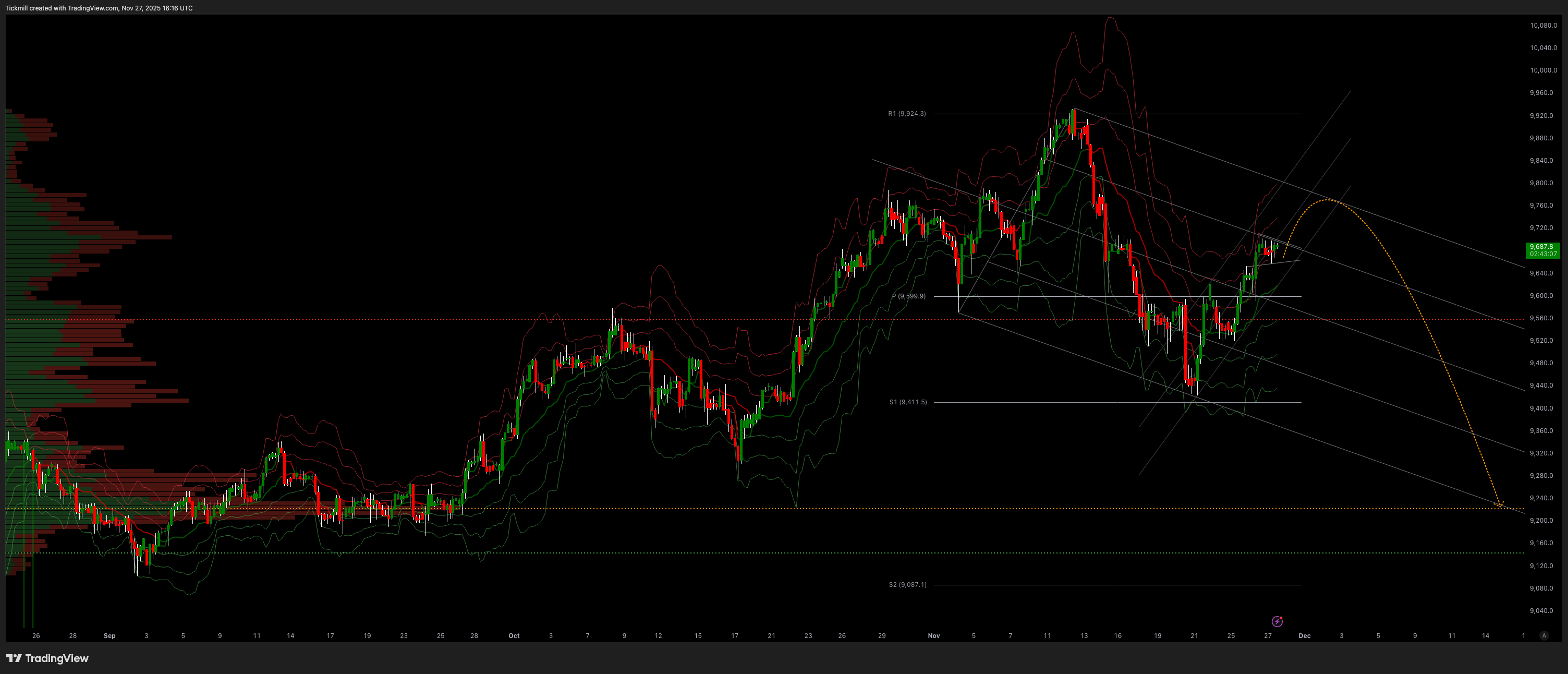

TECHNICAL & TRADE VIEW - FTSE100

Daily VWAP Bullish

Weekly VWAP Bearish

Above 9689 Target 9760

Below 9574 Target 9453

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 72% and 73% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.

Patrick has been involved in the financial markets for well over a decade as a self-educated professional trader and money manager. Flitting between the roles of market commentator, analyst and mentor, Patrick has improved the technical skills and psychological stance of literally hundreds of traders – coaching them to become savvy market operators!