Gold At Record Highs Ahead of Trump Speech in Davos

Gold Rally Continues

Amidst the ongoing uncertainty around the Trump’s pursuit of Greenland, gold has emerged as the standout beneficiary. With risk assets tumbling and traders wary of piling into USD as they normally might, gold has been the preferred destination for the flight to safety we’ve seen this week. Indeed, the futures market has broken out to fresh all-time highs hitting $4,865 an ounce today, now up almost 13% on the year. With geopolitical risks unlikely to subside any time soon, the market looks poised for furtehr upside near-term.

Trump on Watch

Today, the big focus will be on Trump’s speech in Davos. With the high likelihood that Trump unleashes more aggressive rhetoric, gold prices could see a test of the 5000 level before the end of the week. Indeed, given the furore over his pursuit of Greenland and the widespread criticism of his mission, only a surprise walking back from Trump is likely to alter the dynamic here. Instead, with tariffs looming and the lingering threat of some sort of US military action, gold prices look likely to remain bid near-term as safe haven demand remains high. With the US and Europe on the brink of a trade war and USD far less attractive to investors than usual, gold should remain the preferred choice for safe-haven flows near-term.

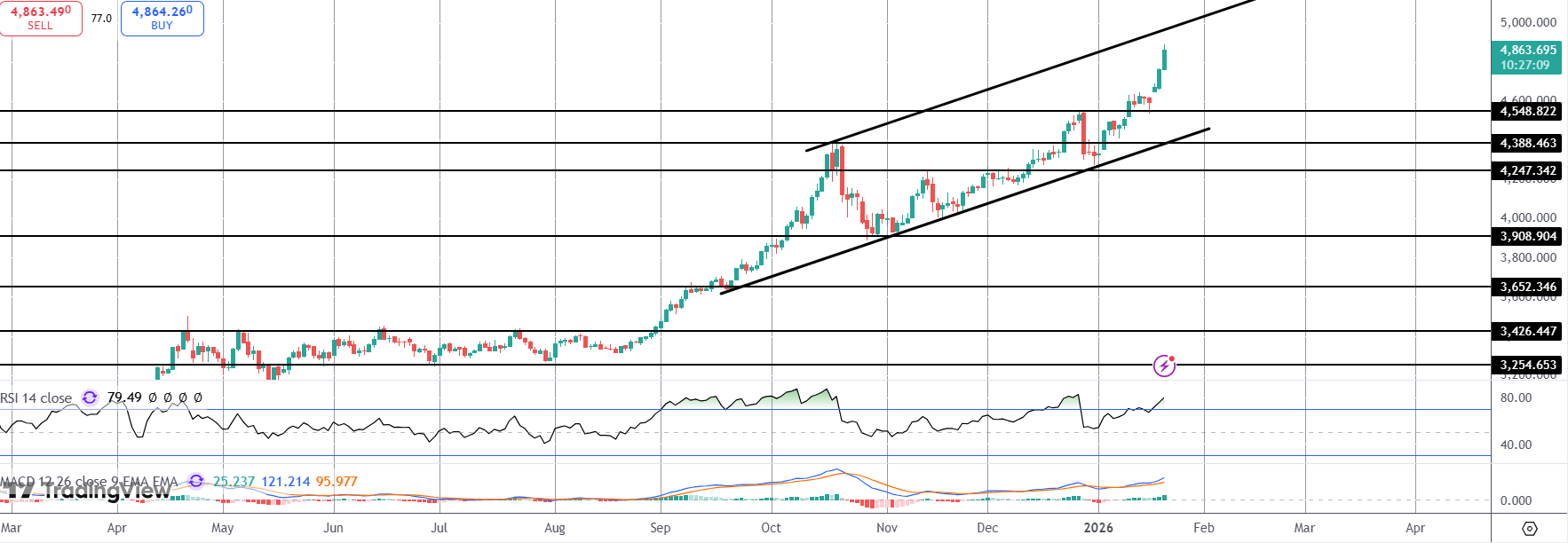

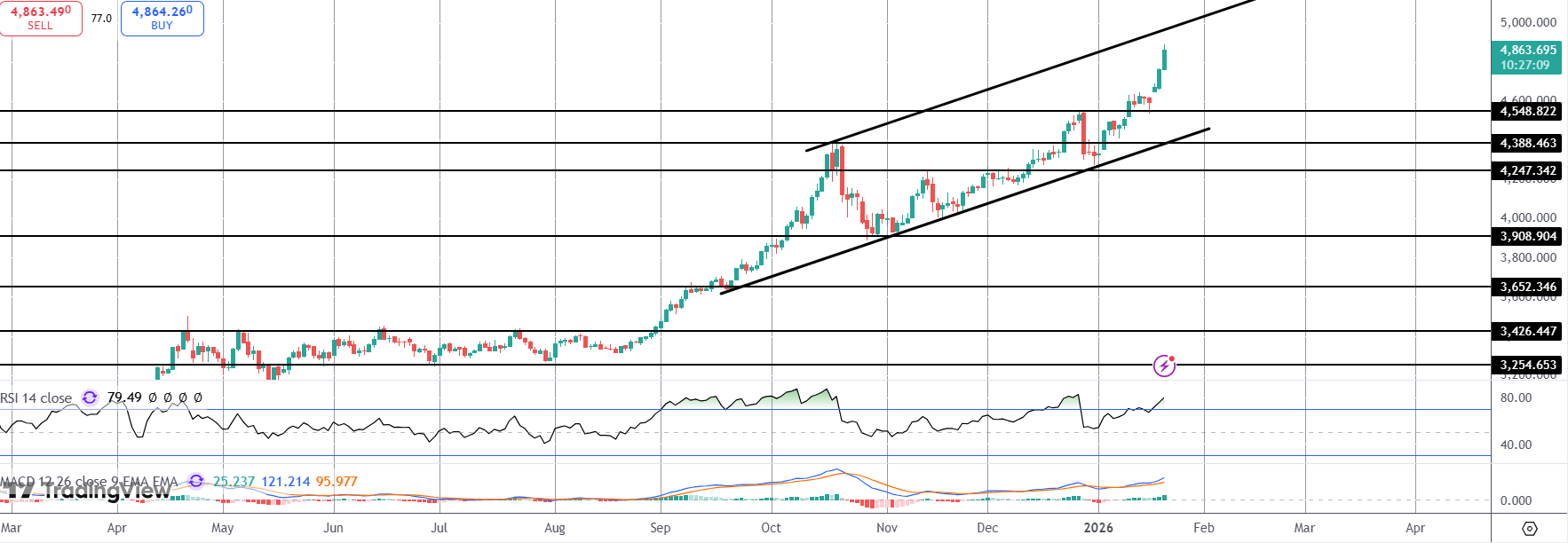

Technical Views

Gold

Gold prices are now fast approaching a test of the 5k level and the bull channel highs. This might be an area where we see some near-term profit taking unless macro drivers fuel a solid continuation higher. Worth noting that we’re seeing bearish divergence in momentum studies here, feeding into the idea of some correction from the first test of 5k.

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 72% and 73% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.

With 10 years of experience as a private trader and professional market analyst under his belt, James has carved out an impressive industry reputation. Able to both dissect and explain the key fundamental developments in the market, he communicates their importance and relevance in a succinct and straight forward manner.