The Crude Oil Chronicles - Episode 2

The latest EIA report, released yesterday, was particularly disappointing for US crude bulls. On the back of seven consecutive weeks of inventory drawdowns and following a report earlier in the week from the API, which suggested an 8th consecutive week, the EIA reported a surplus in its latest report. The Energy Information Administration report, covering the week ending on August 2nd, showed that US crude inventories rose by 2.39 million barrels. The increase was dramatically at odds with the 2.85 million-barrel drawdown which was forecasted and, alongside marking a stark disappointment from the prior week’s 8.5 million barrel drawdown, also puts an end to nearly two months of drawdowns.

Gasoline Inventories

The report also showed that US gasoline inventories were unexpectedly higher at 4.44 million barrels over the week. This was again starkly different to the 0.72 million barrel drawdown forecast. Distillate inventories, which include heating and diesel were also higher over the week, rising b 1.53 million barrels, against a forecast gain of just 0.48 million barrels.

Fresh Trade Tariffs Weighing on Oil

Crude prices have already been under heavy selling pressure over the last week as part of the general risk off tone which has swept across markets. Late last week, president Trump took markets by surprise when he announced a new set of 10% tariffs which will be applied to another $300 billion of Chinese goods entering the US as of September 1st. The news, which was announced via a Tweet from president Trump, came on the back of fresh US / Chinese trade talks which took place last week for the first time since talks broke down in May.

Trump Accuses China

The announcement was met with confusion and disappointment by the markets but, with swift counter action from the Chinese. On Monday, the Chinese Yuan was heavily weakened, sending USCDNH up over the 7 level for the first time in a decade. With tensions continuing to boil over, the US Treasury Dept then issued a statement on Tuesday labelling China a “currency manipulator” – marking the first time which that label has been officially applied since 1994.

China Reacts

China released a counter statement to the claims almost immediately, saying “The United States disregards the facts and unreasonably affixes China with the label of ‘currency manipulators’ which is a behaviour that harms others and oneself…The Chinese side firmly opposes this.” The statement continued saying that the actions of the US will not only “seriously undermine the international financial order, but also trigger financial market turmoil.It will also greatly hinder international trade and the global economic recovery, and ultimately will suffer from it.”

For now, the market waits to see what will happen next. The big concern is that the next round of talks due to take place in September will be abandoned, which be heavily risk-off for markets and highly bearish for oil.

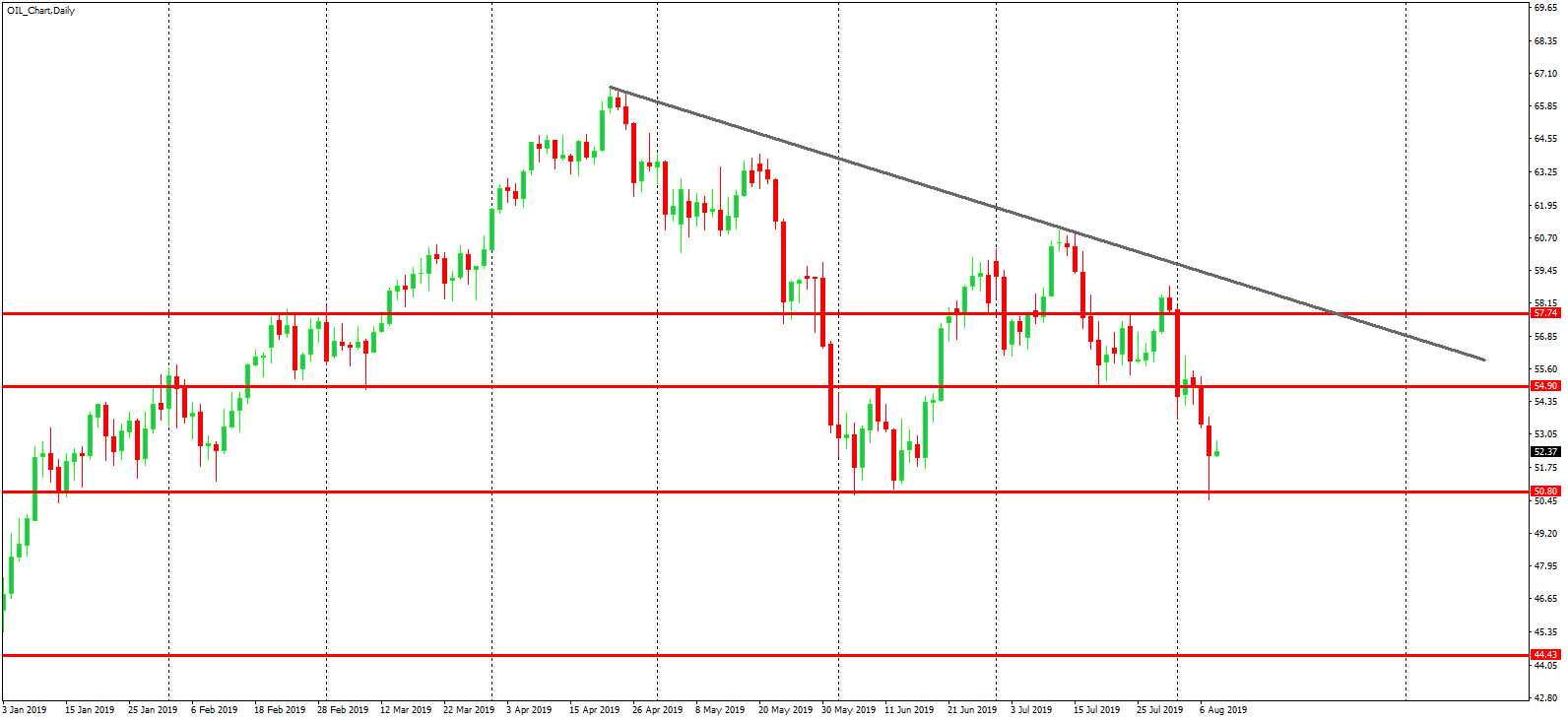

Technical Perspective

The collapse in oil since the rejection from the last test above the 57.74 level has bene severe. Price has broken down through key support at the 54.90 level and is currently challenging the 50.80 support. If this level gives way, the next structural support isn’t down until 44.43 (2019 lows) ahead of the 2018 lows at 42.40. Bulls would need to see a move quickly back above the 54.90 level to ward off near term bearishness which looks unlikely at this stage.

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 72% and 73% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.

With 10 years of experience as a private trader and professional market analyst under his belt, James has carved out an impressive industry reputation. Able to both dissect and explain the key fundamental developments in the market, he communicates their importance and relevance in a succinct and straight forward manner.