Trump Attacks The Fed Over Monetary Policy

While tensions between the US and China have increased dramatically over the last week, it seems that president Trump is placing his focus a little closer to home. Trump has once again been highly vocal in criticising the Fed, which he believes should be easing monetary policy at a higher rate.

Trump Tweets Again

Using his preferred communications channel of Twitter yesterday, Trump wrote:

“Three more Central Banks cut rates.” Our problem is not China - We are stronger than ever, money is pouring into the U.S. while China is losing companies by the thousands to other countries, and their currency is under siege - Our problem is a Federal Reserve that is too.....

— Donald J. Trump (@realDonaldTrump) August 7, 2019

....terrible thing to watch, especially when things could be taken care of sooo easily. We will WIN anyway, but it would be much easier if the Fed understood, which they don’t, that we are competing against other countries, all of whom want to do well at our expense!

— Donald J. Trump (@realDonaldTrump) August 7, 2019

Trump Disappointed With .25% Cut

This latest verbal attack on the Fed comes in the wake of it cutting rates by .25% in July as Trump felt the Fed should have cut by a higher margin. However, this is just the latest in a string of comments which Trump has made both on Twitter and during interviews over the last year. Trump maintains that the trade war with China can be won if the Fed is willing to ease policy at a higher level in order to boost liquidity and buffer the economy. However, many have criticised Trump for attempting to pressure the Fed into making policy decisions.

Former Fed Chairmen Speak Out

Indeed, earlier this week, four former chairmen of the Federal Reserve issued an open letter in the Wall Street Journal calling for the independence of the Fed to be maintained. The letter, which was signed by Paul Volcker, Alan Greenspan, Ben Bernanke and Janet Yellen, said “As former chairs of the board of governors of the Federal Reserve System, we are united in the conviction that the Fed and its chair must be permitted to act independently and in the best interests of the economy, free of short-term political pressures and, in particular, without the threat of removal or demotion of Fed leaders for political reasons.”

Fed To Ease Further?

While the Fed cut rates by .25% at its last meeting, Powell downplayed the likelihood of further easing saying that the move was more of a “mid cycle rate adjustment” rather than the start of a lengthy easing process. However, the Fed might soon be forced into further easing given the global developments taking place. With three central banks over the last week cutting rates at a higher-than-expected levels and trade war tensions continuing to grow. Global yields have plummeted since the latest outbreak in trade tariffs between the US and China. With fears over the prospect of trade talks between the two nations breaking down again, the outlook for yields is bearish.

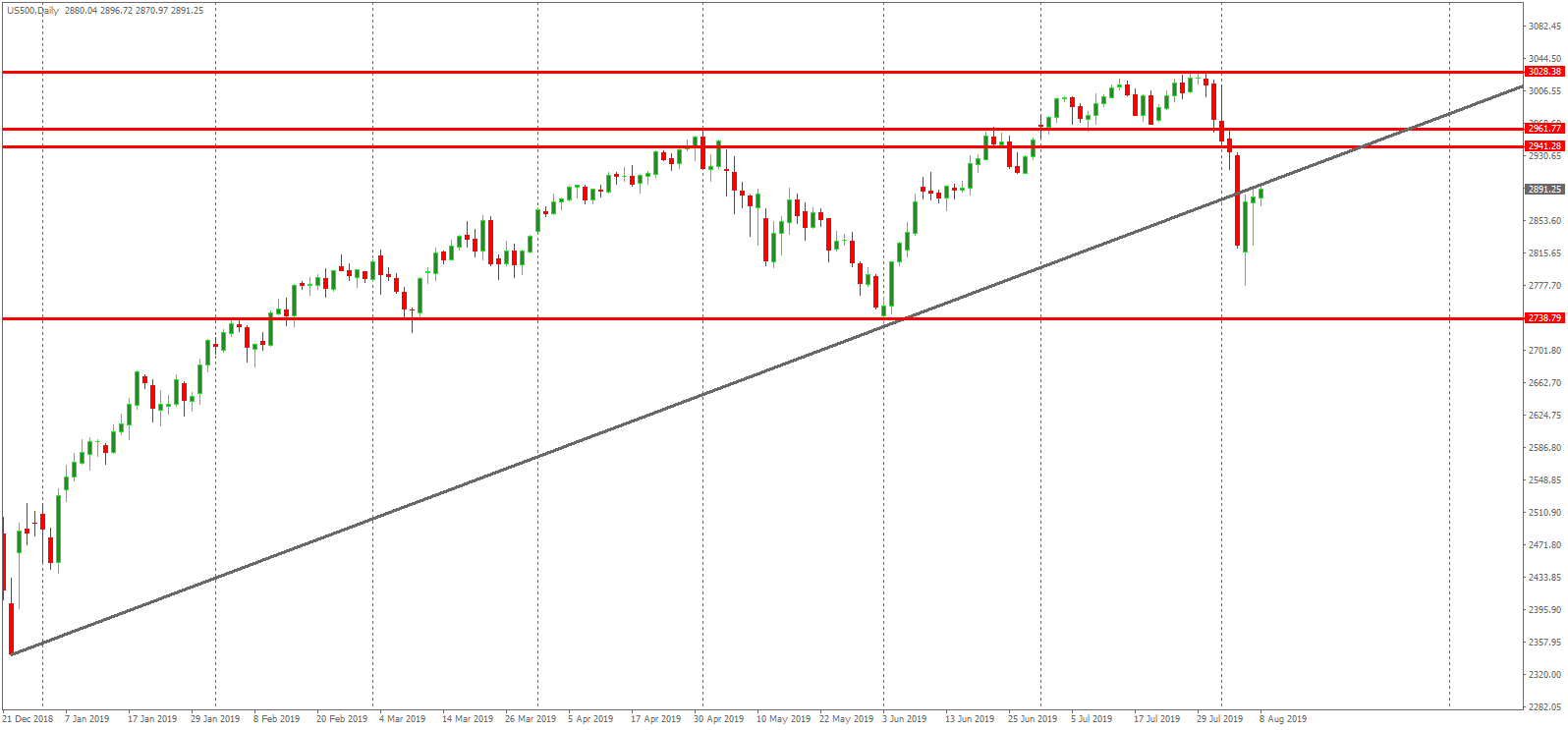

Technical Perspective

The recovery in risk appetite since the equities crash on Monday has seen the S&P trading back up to retest the underside of the broken bullish trend line from 2018 lows. Above here, the structural 2941.28 level offers the next resistance to watch. While the trend line holds, focus remains on a further roll over with the 2738.79 level the next major support to watch.

Please note that this material is provided for informational purposes only and should not be considered as investment advice. Trading in the financial markets is very risky.

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 72% and 73% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.

With 10 years of experience as a private trader and professional market analyst under his belt, James has carved out an impressive industry reputation. Able to both dissect and explain the key fundamental developments in the market, he communicates their importance and relevance in a succinct and straight forward manner.