Institutional Insights: Deutsche Bank Five BTC Decline Drivers

The 5 Key Drivers of the Decline

The report identifies five primary factors contributing to the recent bearish momentum:

1. Risk-Off Sentiment & Equity Correlation Bitcoin failed to act as a defensive hedge during the recent market downturn. Instead, it behaved like a high-growth tech stock.

Correlation: Bitcoin's correlation with the Nasdaq 100 (46%) and S&P 500 (42%) has risen sharply, mirroring levels seen during the 2022 COVID stress.

Safe Havens: Traditional safe havens like Gold and US Treasuries outperformed Bitcoin during recent geopolitical tensions (e.g., US-China trade hostilities).

2. Hawkish Fed Policy Hopes for continued monetary easing were dashed by unexpected hawkish messaging from the Federal Reserve in October and November.

Interest Rate Sensitivity: Bitcoin shows a strong negative correlation with Fed interest rates.

Trigger: Comments from Chair Powell and Governor Lisa Cook suggesting a December rate cut is not guaranteed caused immediate price drops.

3. Stalled Regulatory Momentum Optimism surrounding the "CLARITY Act" (passed by the House in July) has faded due to legislative delays.

The Delay: The US Senate is unlikely to sign the legislation before 2026 due to government shutdowns and disagreements over DeFi identity verification.

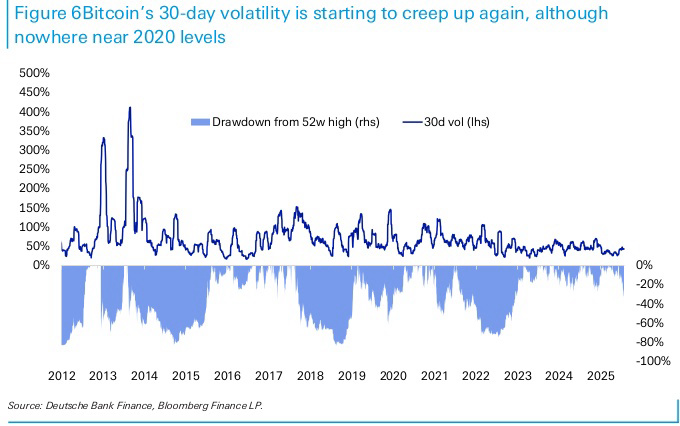

Impact: This uncertainty has halted portfolio integration and contributed to a rise in volatility (from a low of 20% in August to 39% in November).

4. Institutional Outflows & Thin Liquidity A "negative feedback loop" has emerged between falling prices and thinning liquidity.

Order Books: Ask-side liquidity has evaporated during sell-offs, amplifying price crashes.

Reversal: Large investors are withdrawing funds from Bitcoin ETFs, a sharp contrast to the inflows that drove the early-2025 rally.

5. Profit-Taking by Long-Term Holders Unlike previous retail-driven crashes, this correction is marked by significant selling from long-term investors.

Data: Long-term holders sold over 800,000 BTC in the past month—the highest level since January 2024.

Sentiment: The "Crypto Fear and Greed Index" dropped to a yearly low of 11, signaling extreme fear.

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 72% and 73% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.

Patrick has been involved in the financial markets for well over a decade as a self-educated professional trader and money manager. Flitting between the roles of market commentator, analyst and mentor, Patrick has improved the technical skills and psychological stance of literally hundreds of traders – coaching them to become savvy market operators!