FTSE 100 FINISH LINE 26/11/25

FTSE 100 FINISH LINE 26/11/25

Markets were caught off guard by what began as a chaotic fumble—with the OBR’s assessment leaking online before the Chancellor even took the podium—and ultimately landed with a dull thud. The lack of market volatility wasn't a sign of government competence but rather a symptom of exhaustion; the entire playbook had been telegraphed weeks in advance. While ministers might claim vindication, the reality is that investors had simply priced in the bad news long before the official release. The fiscal picture remains fragile despite the optical wins. Welfare costs are projected to swell by another £11bn—driven by reversals on winter fuel payments and the scrapping of the two-child benefit cap—while local government budgets continue to bleed. To secure a seemingly robust £21.7bn in fiscal headroom, the Chancellor had to raid pockets for £26bn in new revenue. Rather than transparent hikes, the strategy relies on a messy cocktail of minor tax code tweaks and the aggressive use of fiscal drag. By extending the freeze on tax thresholds, the government technically adheres to its manifesto pledges, though the millions of workers quietly pulled into higher tax brackets will likely see it as a distinction without a difference. The benchmark FTSE has continued to stage a relief rally, closing up over 0.5% in a volatile trading session.

The UK's tightening budget contrasts with Japan, the U.S., and France, potentially allowing for a cut in Bank of England interest rates. Political implications for Prime Minister Keir Starmer and the Labour government are significant, but markets have likely anticipated much of the impact. For investors in gilts, key details will emerge from debt sales, and a correlation with the declining U.S. Treasury yields offers some cushion ahead of the budget. The Bank of England is also expected to cut rates to address fiscal tightening and lower inflation concerns.

British ad firm WPP is set to be relegated from the FTSE 100 index to the FTSE 250 midcap index amid a 64% fall in shares due to disappointing earnings and a CEO re-shuffle. WPP lost its title as the world's largest ad group to France's Publicis last year, although Publicis shares have also fallen nearly 20% this year. In contrast, Publicis is optimistic and raised its growth forecast. Meanwhile, Interpublic Group will be removed from the S&P 500 due to its acquisition by Omnicom Group.

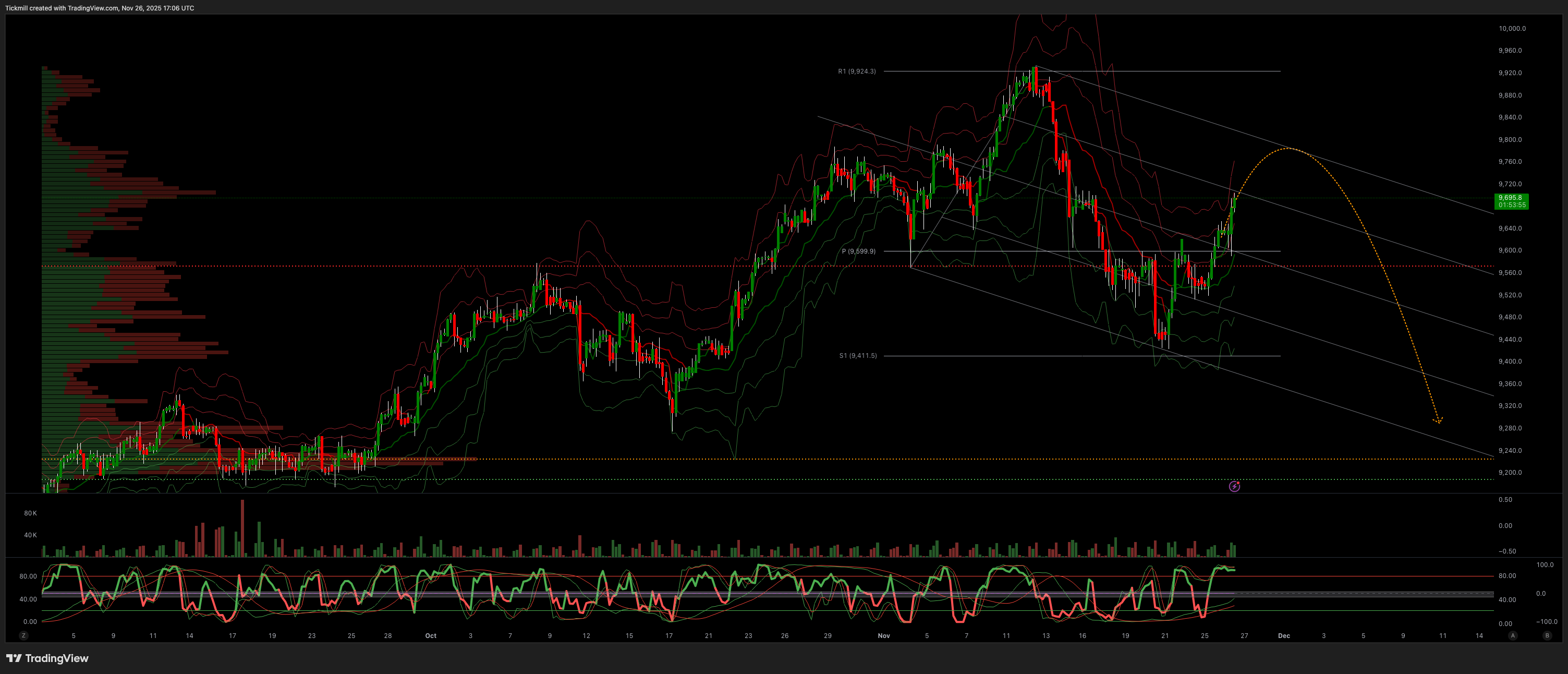

TECHNICAL & TRADE VIEW - FTSE100

Daily VWAP Bullish

Weekly VWAP Bearish

Above 9689 Target 9807

Below 9574 Target 9453

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 72% and 73% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.

Patrick has been involved in the financial markets for well over a decade as a self-educated professional trader and money manager. Flitting between the roles of market commentator, analyst and mentor, Patrick has improved the technical skills and psychological stance of literally hundreds of traders – coaching them to become savvy market operators!