Trader Of The Month

July 2021

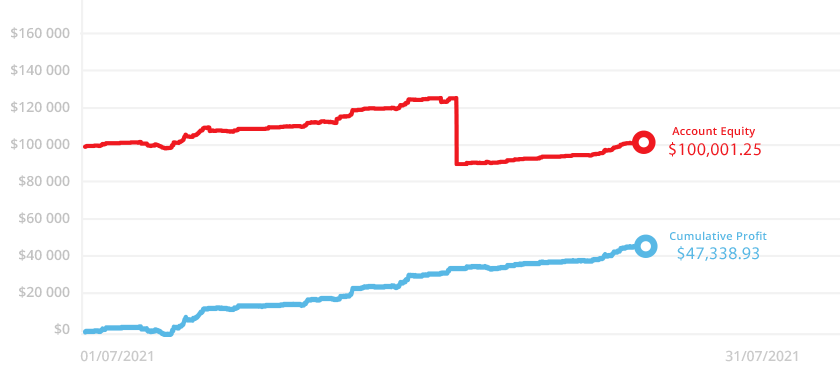

Yifei showed excellent account and risk management skills in July 2021 and got a $1,000 prize!

Read Yifei's interview and see his account statement –to make your own success story

How long have you been trading?

I’ve been trading for 2 years.

How did you get involved in Forex trading?

I used to do futures trading. Later, I tried foreign exchange after being introduced by a friend.

What is your trading style?

My trading style is acombination of long positioning when the market is stable and short positioningduring market volatility periods.

Do you practice risk management?

Yes. I generally controlrisk through net worth control and reasonable allocation of overall marginratio.

What are some good habits smart traders develop?

I think it’s being an awe of the market and forming a balance between trading and keeping a regular routine (you shouldn’t become addicted to trading).

Describe your best/most memorable trade (How much did you profit? What was the strategy? What pair?

The most unforgettable timewas when gold’s price was 1950 in September 2020, a medium and long-term emptyorder was deployed. The position was closed when gold price fell to 1800 inFebruary of this year. The strategy is mainly a big fundamental and valuejudgment.

What advice would you give to new traders?

First, be clear about yourprofit goals. Use your goals to deploy and open positions. Secondly, it is veryimportant to stop the loss in time.

Considering the current state of the market, what do you think are the news/events traders should keep an eye on?

One to focus on is short-termmarket fluctuations after news events occur, and the other is to use newsevents to analzye market sitaution for the long-term. My suggestion is to payattention to the intensity and breadth of the impact of news events and tojudge whether their actual influence will be the same as expected. Also payattention to the market’s reaction to avoid news events’ failure and influence.

What are the most important things you look for in a Forex broker?

What I value most is theoverall strength of the platform, the speed of order execution and transactioncosts. Besides this, the broker shouldn’t shirk responsibility when the lossesare caused by platform issues. Those are the parts where Tickmill has done verywell among all foreign exchange dealers.